National Grid is considering selling its upstate New York gas and electric operations and has even hired two investment banks to oversee the deal, London's The Mail on Sunday newspaper reported over the weekend. Analysts and media both in the United Kingdom and the United States have been speculating for months now that the London-based utility has been seeking to sell or spin off its U.S. operations after a disastrous 12 months in which the company became embroiled in an accounting snafu amid lackluster financial returns. National Grid entered the upstate New York market in 2001 with the $3 billion acquisition of Niagara Mohawk Power Corp. of Syracuse. The Mail's story, which used unnamed sources, says Barclays Capital and Merrill Lynch are advising National Grid on a strategic review and that the sale of the former Niagara Mohawk could generate more than $1.6 billion.

"A sale of Niagara... would meet some shareholders' hopes that National Grid will withdraw from America where it has struggled," the Sunday tabloid wrote. National Grid denied the rumors again Monday as it has consistently done after each story and analyst report. Last week, an analyst with Nomura Equity Research said National Grid would likely seek a sale of its U.S. subsidiaries -- but not until the spring of 2012. "We are committed to our U.S. business and do not comment on market speculation," National Grid spokesman Patrick Stella said Monday.

New York has been a flash point for National Grid's woes in the U.S. because the company was unsuccessful earlier this year in getting regulatory approval for a $360 million electric rate hike for its upstate operations. That case, which was reviewed by the state Public Service Commission for 12 months, uncovered serious issues with the utility's accounting practices, where lavish expenses by senior executives had been unwittingly passed onto ratepayers, including private school tuition, veterinarian bills, political junkets and even the shipment of a wine collection overseas.

The PSC is currently undergoing a major investigation into National Grid's accounting program and how it allocates costs between subsidiaries in its different jurisdictions where it provides gas and electric services. Ultimately, the PSC only approved a $119 million rate hike, with nearly half being set as "temporary" in case consumers are due refunds. Although Niagara Mohawk originally sold for $3 billion in cash and stock, the utility was at that time in the process of shedding major assets such as nuclear power plants that may make National Grid's upstate New York operations much less valuable today.

The Nomura report says it's possible that a potential buyer would value the utility at roughly 35 percent of its regulated rate base, although other factors would also have an impact.

National Grid collects roughly $5 billion in annual revenue from its gas and electric delivery operations in upstate New York, which would give it a potential price tag of $1.75 billion.

Citizens, Residents and Neighbors concerned about ill-conceived wind turbine projects in the Town of Cohocton and adjacent townships in Western New York.

Tuesday, May 31, 2011

Saturday, May 28, 2011

Law eases Perry's concern about wind turbines

PERRY — Residents who opposed the proposed Dairy Hills Wind Farm are reacting with relief to the new town law that essentially bans such projects.

The Town Board on May 11 approved an extensive set of wind energy regulations which make large-scale industrial wind farms difficult or impossible to build.

The law still needs final state approval, but it seems to have ended an often-contentious, six-year debate on the issue.

“Five and a half years ago a mega million-dollar turbine corporation, Horizon, came into our town of Perry,” said Valary Sahrle, who helped for the Citizens for a Healthy Rural Neighborhood group that opposed Dairy Hills.

“My husband and I began to research this wind company and the ills of the project and formed the group,”she said. “This was a group effort of the people that would have had to live under these turbines.”

The group has never been against wind energy, she said. But it opposed the 450-foot wind turbines that could have been located within the town, within 1,500 feet of people’s houses.

Her husband Gerald Sahrle was elected to the Town Board in 2009 and was among those voting to approve the new law. It still permits wind energy, but limits turbines height to 125 feet, among numerous other stipulations.

“Our tireless hard work and long hours have paid off,”Mrs. Sahrle said. “The town boards are to be commended on their decisions and their endless work.”

“I think the town board did an excellent job of balancing the interests of everyone in the community,” said Colleen Green, who also opposed Dairy Hills. “The amended law accommodates commercial wind development by small businesses in the community as well as individual installations.”

Green still notes arguments about the relative efficiency of commercial wind farms; whether the electricity they produced can be stored; and other issues.

“This amended law doesn’t totally preclude industrial development, but it does protect non-participating residents by making sure turbines can’t be placed too close to residents homes,” Green said. “The amended law encourages practical, workable wind power installations that benefit the community and its residents first, and not as an afterthought.”

Wind energy has been controversial in the town since Horizon Wind Energy proposed Dairy Hills in 2005. The project had originally called for 60 to 80 windmills in Perry, Castile, Covington and Warsaw. But its scope was reduced after Castile and Warsaw enacted similar laws regulating turbine development.

The proposal was further reduced to 38 turbines during a major revision.

Horizon ultimately froze the project in 2009. The Town Board voted a year ago to declare the wind farm application null and void.

A 12-month moratorium on wind energy development was enacted last June.

The Town Board on May 11 approved an extensive set of wind energy regulations which make large-scale industrial wind farms difficult or impossible to build.

The law still needs final state approval, but it seems to have ended an often-contentious, six-year debate on the issue.

“Five and a half years ago a mega million-dollar turbine corporation, Horizon, came into our town of Perry,” said Valary Sahrle, who helped for the Citizens for a Healthy Rural Neighborhood group that opposed Dairy Hills.

“My husband and I began to research this wind company and the ills of the project and formed the group,”she said. “This was a group effort of the people that would have had to live under these turbines.”

The group has never been against wind energy, she said. But it opposed the 450-foot wind turbines that could have been located within the town, within 1,500 feet of people’s houses.

Her husband Gerald Sahrle was elected to the Town Board in 2009 and was among those voting to approve the new law. It still permits wind energy, but limits turbines height to 125 feet, among numerous other stipulations.

“Our tireless hard work and long hours have paid off,”Mrs. Sahrle said. “The town boards are to be commended on their decisions and their endless work.”

“I think the town board did an excellent job of balancing the interests of everyone in the community,” said Colleen Green, who also opposed Dairy Hills. “The amended law accommodates commercial wind development by small businesses in the community as well as individual installations.”

Green still notes arguments about the relative efficiency of commercial wind farms; whether the electricity they produced can be stored; and other issues.

“This amended law doesn’t totally preclude industrial development, but it does protect non-participating residents by making sure turbines can’t be placed too close to residents homes,” Green said. “The amended law encourages practical, workable wind power installations that benefit the community and its residents first, and not as an afterthought.”

Wind energy has been controversial in the town since Horizon Wind Energy proposed Dairy Hills in 2005. The project had originally called for 60 to 80 windmills in Perry, Castile, Covington and Warsaw. But its scope was reduced after Castile and Warsaw enacted similar laws regulating turbine development.

The proposal was further reduced to 38 turbines during a major revision.

Horizon ultimately froze the project in 2009. The Town Board voted a year ago to declare the wind farm application null and void.

A 12-month moratorium on wind energy development was enacted last June.

Friday, May 27, 2011

Obama moves to kill Cape Wind

The Obama administration is such a strong supporter of “clean energy” that it has moved to kill Cape Wind, the controversial offshore wind farm the Kennedy family has been fighting for 10 years.

In a May 10 letter to Cape Wind’s developer, the Department of Energy said it wasn’t ready to provide the project with funding and its application was being put on hold.

The loan application was submitted under the $787 billion American Recovery and Reinvestment Act of 2009, which has apparently run out of money — at least for Cape Wind.

The Obama administration’s decision will force Cape Wind’s developers to raise $2 billion from private investors who, so far, have not invested a nickel for construction and who will now be even less likely to invest without government backing.

As the Cape Wind debacle illustrates, Obama isn’t sincerely interested in clean energy. His proposed “clean energy standard” is merely a ruse for seducing Republicans into enacting a carbon cap scheme like cap-and-trade.

In a May 10 letter to Cape Wind’s developer, the Department of Energy said it wasn’t ready to provide the project with funding and its application was being put on hold.

The loan application was submitted under the $787 billion American Recovery and Reinvestment Act of 2009, which has apparently run out of money — at least for Cape Wind.

The Obama administration’s decision will force Cape Wind’s developers to raise $2 billion from private investors who, so far, have not invested a nickel for construction and who will now be even less likely to invest without government backing.

As the Cape Wind debacle illustrates, Obama isn’t sincerely interested in clean energy. His proposed “clean energy standard” is merely a ruse for seducing Republicans into enacting a carbon cap scheme like cap-and-trade.

Thursday, May 26, 2011

DEIS - Draft Environmental Impact Statement - for the Two Turbine Expansion of the Howard Wind Power Project

This page contains the DEIS - Draft Environmental Impact Statement - for the Two Turbine Expansion of the Howard Wind Power Project. The entire document is available here for download, with all text, figures, and appendices. All files are in PDF format, unless otherwise noted:

Text

•DEIS text

Text

•DEIS text

Wednesday, May 25, 2011

Palouse Wind Project Receives Critical CUP Approval

First Wind, an independent U.S.-based wind energy company, today announced that it has received the Conditional Use Permit (CUP) for its Palouse Wind Project. The CUP, a necessary approval to build and operate the project in Whitman County, was reviewed and approved by an independent, specialized Hearing Examiner, who is employed by Whitman County.

“This is a critical milestone for the Palouse Wind Project. It takes us one step closer to building a project that we hope will help stimulate the economy in the region and bring construction and long term operations jobs to the area,” said Ben Fairbanks, Director of Northwest Business Development for First Wind. “This is a major project for First Wind and for Whitman County, and we are excited to continue our relationship with the surrounding community and the many landowners and farmers who have helped us make this project a reality.”

Oakesdale Mayor Dennis Palmer agreed. “Since the early 1970s we’ve seen businesses leave the town of Oakesdale, and they never come back,” Mayor Palmer stated when testifying in favor of the project at the CUP hearing. “When First Wind came to Oakesdale…and presented what they were going to do, it was kind of like dollars from heaven dropping in.”

The Palouse Wind project, which is as yet undetermined in size, has been permitted for up to 65 wind turbines and 195 megawatts (MW), which is enough energy to power approximately 25,000 homes annually.

Palouse Wind will represent a major investment in Whitman County by creating more than 100 construction jobs and 5-10 direct full-time jobs once the wind facility is operational. First Wind is committed to locally sourcing as much of the labor and supplies as possible.

Before issuing the CUP, Whitman County conducted an 8-month long analysis of the potential impacts of the project under the State Environmental Policy Act (SEPA). The Final Environmental Impact Statement, which was issued in March 2011, found that application of the mitigation measures developed as a result of the SEPA review will limit, and in most circumstances eliminate, adverse impacts associated with the project. Road construction and infrastructure work could possibly begin as early as this year, with the bulk of the project construction to begin in 2012.

“This is a critical milestone for the Palouse Wind Project. It takes us one step closer to building a project that we hope will help stimulate the economy in the region and bring construction and long term operations jobs to the area,” said Ben Fairbanks, Director of Northwest Business Development for First Wind. “This is a major project for First Wind and for Whitman County, and we are excited to continue our relationship with the surrounding community and the many landowners and farmers who have helped us make this project a reality.”

Oakesdale Mayor Dennis Palmer agreed. “Since the early 1970s we’ve seen businesses leave the town of Oakesdale, and they never come back,” Mayor Palmer stated when testifying in favor of the project at the CUP hearing. “When First Wind came to Oakesdale…and presented what they were going to do, it was kind of like dollars from heaven dropping in.”

The Palouse Wind project, which is as yet undetermined in size, has been permitted for up to 65 wind turbines and 195 megawatts (MW), which is enough energy to power approximately 25,000 homes annually.

Palouse Wind will represent a major investment in Whitman County by creating more than 100 construction jobs and 5-10 direct full-time jobs once the wind facility is operational. First Wind is committed to locally sourcing as much of the labor and supplies as possible.

Before issuing the CUP, Whitman County conducted an 8-month long analysis of the potential impacts of the project under the State Environmental Policy Act (SEPA). The Final Environmental Impact Statement, which was issued in March 2011, found that application of the mitigation measures developed as a result of the SEPA review will limit, and in most circumstances eliminate, adverse impacts associated with the project. Road construction and infrastructure work could possibly begin as early as this year, with the bulk of the project construction to begin in 2012.

Monday, May 23, 2011

First Wind issues $200M in notes for new wind projects

First Wind Holdings Inc. has raised $200 million by issuing notes through its subsidiary First Wind Capital LLC, which the company said it will use to pay down debt and finance new wind projects.

The senior secured notes, due 2018, were issued at par with a coupon of 10.25 percent, officials said. Credit Suisse, Deutsche Bank Securities, Goldman Sachs & Co. and RBS acted as joint book-running managers.

According to Paul Gaynor, CEO of Boston-based First Wind, the planned projects will be in the Northeast, the West and Hawaii, and should be operational “by the end of 2012.”

First Wind hatched the plan to raise funds privately after shelving a proposed initial public offering, last fall. lan B. Gaynor said at the time the company expects to complete private financing in the range of $300 million in the first half of 2011.

Earlier this month, First Wind reached an agreement with Algonquin Power and Utilities Corp. and Emera Inc. to jointly develop and operate new wind projects in the Northeast, through the formation of a new operating company, called Northeast Wind.

The senior secured notes, due 2018, were issued at par with a coupon of 10.25 percent, officials said. Credit Suisse, Deutsche Bank Securities, Goldman Sachs & Co. and RBS acted as joint book-running managers.

According to Paul Gaynor, CEO of Boston-based First Wind, the planned projects will be in the Northeast, the West and Hawaii, and should be operational “by the end of 2012.”

First Wind hatched the plan to raise funds privately after shelving a proposed initial public offering, last fall. lan B. Gaynor said at the time the company expects to complete private financing in the range of $300 million in the first half of 2011.

Earlier this month, First Wind reached an agreement with Algonquin Power and Utilities Corp. and Emera Inc. to jointly develop and operate new wind projects in the Northeast, through the formation of a new operating company, called Northeast Wind.

Friday, May 20, 2011

First Wind Issues $200 Million in Seven-Year Senior Secured Notes

First Wind, an independent U.S.-based wind energy company, today announced that its subsidiary, First Wind Capital, LLC, has issued $200 million in senior secured notes due 2018. The notes were issued at par with a coupon of 10.25 percent. First Wind will use proceeds from this offering to repay existing indebtedness, as well as to develop and build new wind projects across the country.

“This is an important milestone for our company as it is our debut in the capital markets. It will provide capital for future projects we hope will comprise more than 350 megawatts of clean energy,” said Paul Gaynor, CEO of First Wind. “These projects will be in our core target markets of the Northeast, the West and Hawaii and we plan to bring those projects into commercial operation by the end of 2012.

Mr. Gaynor added, “We appreciate the commitment of our new financial investors, which will help First Wind deliver clean, renewable energy, as well as significant economic benefits in terms of construction jobs, local tax revenues and work for local businesses in the communities where we are located.”

“These next projects will build off our existing platform of 13 projects in operation and under construction,” said Michael Alvarez, President and CFO of First Wind. “We look forward to working with our new investors. Since the beginning of 2009, First Wind and its subsidiaries have refinanced, raised or received approximately $2.8 billion (excluding the notes issued today) in 26 refinancing and new capital-raising activities and customer prepayments. That demonstrates the strength and validity of our strategy and execution.”

Credit Suisse, Deutsche Bank Securities, Goldman Sachs & Co, and RBS acted as Joint Book-Running Managers.

“This is an important milestone for our company as it is our debut in the capital markets. It will provide capital for future projects we hope will comprise more than 350 megawatts of clean energy,” said Paul Gaynor, CEO of First Wind. “These projects will be in our core target markets of the Northeast, the West and Hawaii and we plan to bring those projects into commercial operation by the end of 2012.

Mr. Gaynor added, “We appreciate the commitment of our new financial investors, which will help First Wind deliver clean, renewable energy, as well as significant economic benefits in terms of construction jobs, local tax revenues and work for local businesses in the communities where we are located.”

“These next projects will build off our existing platform of 13 projects in operation and under construction,” said Michael Alvarez, President and CFO of First Wind. “We look forward to working with our new investors. Since the beginning of 2009, First Wind and its subsidiaries have refinanced, raised or received approximately $2.8 billion (excluding the notes issued today) in 26 refinancing and new capital-raising activities and customer prepayments. That demonstrates the strength and validity of our strategy and execution.”

Credit Suisse, Deutsche Bank Securities, Goldman Sachs & Co, and RBS acted as Joint Book-Running Managers.

Thursday, May 19, 2011

Sheffield neighbors file photos of stormwater runoff failures at First Wind

Sheffield Neighbors File Evidence of Stormwater Runoff Failures at First Wind Site

Photographic Evidence Supports Motion to Stay at Vermont Supreme Court

Wednesday afternoon neighbors of First Wind’s Sheffield wind project filed additional evidence with the Vermont Supreme Court to support their request to halt construction while the Court considers their appeal of the stormwater permit. Recent photographs of the site show that inadequate stormwater runoff protection has done irreparable harm at the project site and that the Best Management Practices (BMPs) required by the Vermont Agency of Natural Resources (ANR) permit have not protected the site’s five headwater streams.

Project neighbor and Appellant in the case Rob Pforzheimer, commenting on the status of the site, said, “The site is a mess. Not only are they out of compliance with the permit, but the permit isn’t working anyway. The photos of the site make it very clear that First Wind and ANR’s assurances that the BMPs would work were wrong. The permit has completely failed to protect these important headwater streams. The Court should rule in favor of the Motion to Stay immediately before more harm is done at the site.”

In an affidavit filed supporting the request, hydrologist Andrews Torizzo stated, “The site is not properly stabilized and disturbed soils are exposed to mobilization by precipitation and snowmelt.”

The lack of stabilization at the site can be seen in the photographs. Photos demonstrate that the inappropriate placement of control devices such as hay bales and silt fences has allowed sediment to travel unimpeded into area streams (photos 2B, 3A, 3B, 4A, 4B, 6A). Other photographs show that necessary sediment basins have not been installed properly, and therefore sediment is allowed to run off the site unchecked. (photos 7A).

The ANR permit has allowed First Wind to follow BMPs, but did not apply the requirements of the Vermont Water Quality Standards which require pre-construction baseline monitoring, and monitoring during construction activity to ensure that the water is not degraded from sediment in the stormwater runoff reaching the streams. Further complicating the efforts to protect the streams is ANR’s recent assertion that the activities on the portion of the site that are releasing the most sediment is considered logging, which allows for an even lower level of protection called Acceptable Management Practices (AMPs). The neighbors want construction to cease until the Supreme Court decides whether to revoke the permit that was upheld by the Environmental Court. First Wind recently restarted construction at the site after a pause during the winter.

Neighbor and fisheries biologist Paul Brouha described the impacts of the erosion on habitat in a filing to the Court that accompanied the photos. Brouha said, “As this sediment moves downstream its biological effect is to entomb emerging brook trout eggs or emerging alevins, to smother these organisms in the gravels as the flow of oxygenated water through the gravels is reduced, and to block the emergence of mayflies and other invertebrates that serve as fish food. Further, the sediment will fill in pools and reduce the available trout cover in them. “

Lawyer for the Appellants Stephanie Kaplan expressed hope the new evidence would help the Court understand their urgency. She said, “We believe these photographs demonstrate convincingly what is at stake by allowing First Wind to continue construction with an inadequate permit. The damage done is already permanent and substantial, but the spring construction season has just barely started. Work at the site must be stopped before further runoff can harm the natural resources on the site.”

Energize Vermont was created to educate and advocate for establishing renewable energy solutions that are in harmony with the irreplaceable character of Vermont, and that contribute to the well-being of all her people. This mission is achieved by researching, collecting, and analyzing information from all sources; and disseminating it to the public, community leaders, legislators, media, and regulators for the purpose of ensuring informed decisions for long term stewardship of our communities.

Photographic Evidence Supports Motion to Stay at Vermont Supreme Court

Wednesday afternoon neighbors of First Wind’s Sheffield wind project filed additional evidence with the Vermont Supreme Court to support their request to halt construction while the Court considers their appeal of the stormwater permit. Recent photographs of the site show that inadequate stormwater runoff protection has done irreparable harm at the project site and that the Best Management Practices (BMPs) required by the Vermont Agency of Natural Resources (ANR) permit have not protected the site’s five headwater streams.

Project neighbor and Appellant in the case Rob Pforzheimer, commenting on the status of the site, said, “The site is a mess. Not only are they out of compliance with the permit, but the permit isn’t working anyway. The photos of the site make it very clear that First Wind and ANR’s assurances that the BMPs would work were wrong. The permit has completely failed to protect these important headwater streams. The Court should rule in favor of the Motion to Stay immediately before more harm is done at the site.”

In an affidavit filed supporting the request, hydrologist Andrews Torizzo stated, “The site is not properly stabilized and disturbed soils are exposed to mobilization by precipitation and snowmelt.”

The lack of stabilization at the site can be seen in the photographs. Photos demonstrate that the inappropriate placement of control devices such as hay bales and silt fences has allowed sediment to travel unimpeded into area streams (photos 2B, 3A, 3B, 4A, 4B, 6A). Other photographs show that necessary sediment basins have not been installed properly, and therefore sediment is allowed to run off the site unchecked. (photos 7A).

The ANR permit has allowed First Wind to follow BMPs, but did not apply the requirements of the Vermont Water Quality Standards which require pre-construction baseline monitoring, and monitoring during construction activity to ensure that the water is not degraded from sediment in the stormwater runoff reaching the streams. Further complicating the efforts to protect the streams is ANR’s recent assertion that the activities on the portion of the site that are releasing the most sediment is considered logging, which allows for an even lower level of protection called Acceptable Management Practices (AMPs). The neighbors want construction to cease until the Supreme Court decides whether to revoke the permit that was upheld by the Environmental Court. First Wind recently restarted construction at the site after a pause during the winter.

Neighbor and fisheries biologist Paul Brouha described the impacts of the erosion on habitat in a filing to the Court that accompanied the photos. Brouha said, “As this sediment moves downstream its biological effect is to entomb emerging brook trout eggs or emerging alevins, to smother these organisms in the gravels as the flow of oxygenated water through the gravels is reduced, and to block the emergence of mayflies and other invertebrates that serve as fish food. Further, the sediment will fill in pools and reduce the available trout cover in them. “

Lawyer for the Appellants Stephanie Kaplan expressed hope the new evidence would help the Court understand their urgency. She said, “We believe these photographs demonstrate convincingly what is at stake by allowing First Wind to continue construction with an inadequate permit. The damage done is already permanent and substantial, but the spring construction season has just barely started. Work at the site must be stopped before further runoff can harm the natural resources on the site.”

Energize Vermont was created to educate and advocate for establishing renewable energy solutions that are in harmony with the irreplaceable character of Vermont, and that contribute to the well-being of all her people. This mission is achieved by researching, collecting, and analyzing information from all sources; and disseminating it to the public, community leaders, legislators, media, and regulators for the purpose of ensuring informed decisions for long term stewardship of our communities.

Wednesday, May 18, 2011

NY legislature moves to expand net metering

The New York State Senate and Assembly have voted to expand net metering for farm and non-residential customers who generate their own power with wind or solar.

Through the act of net metering, electric customers who produce their own electricity via wind or solar renewable sources are able to send extra electricity produced back to the grid and receive credit therefore. It is a way essentially, to roll one’s electric meter backward.

The expansion would allow remote net metering. That is, provided the customer produces and uses energy in the same load zone serviced by the same electric utility, the customer could produce electricity at one spot – say a windy ridge – but use electricity at another, perhaps a parcel or two over where the barn and homestead are. Current legislation requires production and consumption at the same electric meter.

The Senate and Assembly bills are, respectively, S. 3407 and A. 6270-b. Most recently the Senate bill was returned to the Assembly. No word yet whether Governor Cuomo, once he receives it, will sign the bill into law.

Through the act of net metering, electric customers who produce their own electricity via wind or solar renewable sources are able to send extra electricity produced back to the grid and receive credit therefore. It is a way essentially, to roll one’s electric meter backward.

The expansion would allow remote net metering. That is, provided the customer produces and uses energy in the same load zone serviced by the same electric utility, the customer could produce electricity at one spot – say a windy ridge – but use electricity at another, perhaps a parcel or two over where the barn and homestead are. Current legislation requires production and consumption at the same electric meter.

The Senate and Assembly bills are, respectively, S. 3407 and A. 6270-b. Most recently the Senate bill was returned to the Assembly. No word yet whether Governor Cuomo, once he receives it, will sign the bill into law.

Tuesday, May 17, 2011

Perry approves de facto ban on industrial wind farms

PERRY — A de facto ban on industrial wind farms has been approved by the Town Board.

Board members unanimously approved the new law at Wednesday’s meeting. It replaces previous regulations enacted in 2006.

Height is now limited to 125 feet, with a maximum nameplate rating of 110 kilowatts. No shadow flicker will be allowed except on the owner’s property.

A minimum setback has been set at twice the windmill’s overall height from any road, non-participating structure or above-ground utilities. Commercial turbines would also need to be at least 1,500 feet from the nearest non-participating lot line.

Noise would be limited to no more than six decibels above the average ambient nighttime level, measured at uninvolved parcels’ lot lines — meaning properties whose owners don’t have leases or easements with the project owners.

Upon any complaints, monitoring would be conducted at the owner’s expense by an expert both the owner and Town Board have agreed upon. The monitoring would include low-frequency noise emissions.

A special use permit will be required for any commercial wind energy system or component. Zoning permits would be needed for commercial or residential system, with the former also a site plan review.

An application fee of $10 per kilowatt hour of nameplate capacity would also be required. Nameplate capacity is the intended full-load capacity of a generating system.

Wind energy has been highly controversial in the town since Horizon Wind Energy proposed the Dairy Hills Wind Farm in 2005.

Horizon ultimately froze the project in 2009 due to its uncertainty. The Town Board voted a year ago to declare the wind farm application null and void.

A 12-month moratorium on wind energy development was enacted last June.

Board members unanimously approved the new law at Wednesday’s meeting. It replaces previous regulations enacted in 2006.

Height is now limited to 125 feet, with a maximum nameplate rating of 110 kilowatts. No shadow flicker will be allowed except on the owner’s property.

A minimum setback has been set at twice the windmill’s overall height from any road, non-participating structure or above-ground utilities. Commercial turbines would also need to be at least 1,500 feet from the nearest non-participating lot line.

Noise would be limited to no more than six decibels above the average ambient nighttime level, measured at uninvolved parcels’ lot lines — meaning properties whose owners don’t have leases or easements with the project owners.

Upon any complaints, monitoring would be conducted at the owner’s expense by an expert both the owner and Town Board have agreed upon. The monitoring would include low-frequency noise emissions.

A special use permit will be required for any commercial wind energy system or component. Zoning permits would be needed for commercial or residential system, with the former also a site plan review.

An application fee of $10 per kilowatt hour of nameplate capacity would also be required. Nameplate capacity is the intended full-load capacity of a generating system.

Wind energy has been highly controversial in the town since Horizon Wind Energy proposed the Dairy Hills Wind Farm in 2005.

Horizon ultimately froze the project in 2009 due to its uncertainty. The Town Board voted a year ago to declare the wind farm application null and void.

A 12-month moratorium on wind energy development was enacted last June.

Monday, May 16, 2011

First Wind in Limbo

As wind company Pattern Energy moves forward with plans to develop on Molokai, First Wind, a company that had been in discussion with the community for several years, is not giving up without a fight.

However, the state Public Utilities Commission (PUC) officially denied First Wind’s request for an extension for them to pursue a land deal for a wind farm on Molokai last week. This means the company is out of the running to be involved in the efforts to build a wind farm on Molokai.

But the PUC has yet to make a decision on First Wind’s latest request: start over the state’s neighbor island project’s bidding process from scratch.

First Wind CEO Paul Gaynor sent a letter to the PUC on April 25, stating that the original 2008 agreement with the Hawaiian Electric Company (HECO) did not give one developer the right over the other to delegate part of the wind farm to a new developer.

Soon after First Wind missed the March 18 deadline to present a land deal and term sheet to the PUC, Castle & Cooke struck a deal with Pattern Energy to develop 200 megawatts (MW) on Molokai. Pattern has an agreement with Molokai Properties Ltd. (MPL) to lease their land on the west end, pending the project moves forward.

First Wind officials did not return multiple attempts at contact from the Dispatch.

A few days after First Wind send their request for re-bidding to the PUC, anti-wind group Friends of Lanai (FOL) sent the PUC a petition to intervene, also asking for the competitive bidding process to be reopened.

“[We want] to get access to documents we’ve been unable to see, like the original document splitting up the megawatts,” said Robin Kaye of FOL. “Why is this so secretive?”

HECO recently sent a motion to the PUC in opposition to FOL’s request, stating their petition was not filed within an appropriate time frame (over 500 days past the filing of the initial agreement). They also stated FOL has other venues which are more appropriate for them to comment.

Kaye said using other venues is irrelevant, since it is the PUC that makes the final decisions.

“We want to get the state off of its dependence on foreign oil as much as anybody else does, [we] just don’t think this is the way to do it,” he said.

In the meantime, Pattern Energy, in collaboration with development company Bio-Logical Capital, is meeting with individuals on Molokai to discuss “visions and goals” as well as concerns about the project.

`Aha Ki`ole conducted a survey on Molokai in March, asking residents whether or not they supported wind development. Ninety-three percent said were against a wind farm on the island.

However, the state Public Utilities Commission (PUC) officially denied First Wind’s request for an extension for them to pursue a land deal for a wind farm on Molokai last week. This means the company is out of the running to be involved in the efforts to build a wind farm on Molokai.

But the PUC has yet to make a decision on First Wind’s latest request: start over the state’s neighbor island project’s bidding process from scratch.

First Wind CEO Paul Gaynor sent a letter to the PUC on April 25, stating that the original 2008 agreement with the Hawaiian Electric Company (HECO) did not give one developer the right over the other to delegate part of the wind farm to a new developer.

Soon after First Wind missed the March 18 deadline to present a land deal and term sheet to the PUC, Castle & Cooke struck a deal with Pattern Energy to develop 200 megawatts (MW) on Molokai. Pattern has an agreement with Molokai Properties Ltd. (MPL) to lease their land on the west end, pending the project moves forward.

First Wind officials did not return multiple attempts at contact from the Dispatch.

A few days after First Wind send their request for re-bidding to the PUC, anti-wind group Friends of Lanai (FOL) sent the PUC a petition to intervene, also asking for the competitive bidding process to be reopened.

“[We want] to get access to documents we’ve been unable to see, like the original document splitting up the megawatts,” said Robin Kaye of FOL. “Why is this so secretive?”

HECO recently sent a motion to the PUC in opposition to FOL’s request, stating their petition was not filed within an appropriate time frame (over 500 days past the filing of the initial agreement). They also stated FOL has other venues which are more appropriate for them to comment.

Kaye said using other venues is irrelevant, since it is the PUC that makes the final decisions.

“We want to get the state off of its dependence on foreign oil as much as anybody else does, [we] just don’t think this is the way to do it,” he said.

In the meantime, Pattern Energy, in collaboration with development company Bio-Logical Capital, is meeting with individuals on Molokai to discuss “visions and goals” as well as concerns about the project.

`Aha Ki`ole conducted a survey on Molokai in March, asking residents whether or not they supported wind development. Ninety-three percent said were against a wind farm on the island.

Thursday, May 12, 2011

Wind firm to Howard: Blades to spin by October

If everything goes as planned, a wind farm in the Town of Howard will be functional in about six months, according to Supervisor Don Evia.

EverPower Renewables has told town officials it's planning on having a 25 turbine farm functional by mid October. Evia Wednesday night said he was surprised the company expects to be running by then.

“That’s what I’m taking out of the latest communication,” said Evia. “That’s what they are telling the town.”

Read the entire article

EverPower Renewables has told town officials it's planning on having a 25 turbine farm functional by mid October. Evia Wednesday night said he was surprised the company expects to be running by then.

“That’s what I’m taking out of the latest communication,” said Evia. “That’s what they are telling the town.”

Read the entire article

North wind farm market dries up

Four proposed wind farms in Jefferson County will never get off the drawing board unless they can find someone to buy their power. And the most likely buyer — the New York Power Authority — has refused to purchase any electricity generated by wind here.

The decision is in retaliation to the county Legislature's 14-0 vote in March to oppose NYPA's plan to put wind turbines in Lake Ontario.

"We have no plans to enter into any agreement in Jefferson County based on the vote of the county legislature," said Richard M. Kessel, president and chief executive officer of New York Power Authority. "We respect their decision, and we won't place any of our wind turbines in the area, but we won't enter into any agreement with any wind power project in the county."

In Jefferson County, Acciona Wind Energy USA's St. Lawrence Wind Farm, BP Alternative Energy's Cape Vincent Wind Farm and Iberdrola's Horse Creek Wind Farm are still in the local approval process.

Read the entire article

The decision is in retaliation to the county Legislature's 14-0 vote in March to oppose NYPA's plan to put wind turbines in Lake Ontario.

"We have no plans to enter into any agreement in Jefferson County based on the vote of the county legislature," said Richard M. Kessel, president and chief executive officer of New York Power Authority. "We respect their decision, and we won't place any of our wind turbines in the area, but we won't enter into any agreement with any wind power project in the county."

In Jefferson County, Acciona Wind Energy USA's St. Lawrence Wind Farm, BP Alternative Energy's Cape Vincent Wind Farm and Iberdrola's Horse Creek Wind Farm are still in the local approval process.

Read the entire article

Tuesday, May 10, 2011

First Wind Begins Commercial Operations at Milford II Wind Project

BARF ALERT - example of paid for journalism

First Wind, an independent U.S.-based wind energy company, today announced that the construction of the 102 megawatt (MW) Milford Wind Corridor Phase II (Milford II) project has been completed and commercial operations have begun. Located in the counties of Millard and Beaver, Utah, the Milford Phases I and II are the two largest wind energy projects in Utah.

The 102 MW project, which features 68 1.5 MW GE turbines is located north of the 204 MW Milford Wind Corridor Phase I project (Milford I). At 306 MW, the combined output of Milford I and II has the capacity to generate enough energy to power up to 64,000 homes.

Pursuant to a power purchase agreement with Southern California Public Power Authority (SCPPA), power generated by Milford II is being supplied to the Los Angeles Department of Water and Power (LADWP) and Glendale Water and Power. Milford II adds to the already significant renewable energy that is being produced and delivered to Los Angeles, Burbank and Pasadena, California from the Milford I project.

“We are proud to announce the completion of this high quality wind project,” said Paul Gaynor, CEO, First Wind. “This project is now delivering clean, renewable power for use by thousands of homes and businesses. Putting the pieces together on Milford II has been a remarkable experience, and we are proud to have partnered with the State of Utah, our host counties of Beaver and Millard, our PPA partners – SCPPA, LADWP and Glendale – our landowner group including the Bureau of Land Management and the State of Utah School and Institutional Trust Lands Administration, our general contractor RMT, our subcontractors, and our lenders. This day is a celebration for everyone involved.”

“The Milford II Wind Power Project is an example of LADWP working smarter while boosting the amount of renewable energy provided to customers and reducing greenhouse gas emissions,” said LADWP General Manager Ronald O. Nichols. “With the completion of this project we ensure the delivery of 102 megawatts of wind power at a set price for the next 20 years.”

“We are pleased for the continued and successful working relationship with First Wind,” said Bill D. Carnahan, Executive Director of the Southern California Public Power Authority. “These projects are cost effective resources which benefit the local communities in Utah, while also supporting the renewable objectives of our communities in California. Delivering clean energy is a partnership in which we all share common objectives.”

RMT, which led the construction of the Milford I project in 2009, again led the construction activities for the Milford II project. Construction on the Milford II project began in the summer of 2010.

“We are pleased to have completed another project with First Wind,” said Steve Johansen, RMT President. “As with the first phase of the project, RMT hired local workers and subcontractors whenever possible so that the construction of this expansion provided economic benefits for the surrounding community and Utah.”

The Milford Wind project has been an ongoing source of jobs, business activity, and tax revenue for Millard, Beaver and adjacent counties. Milford II supported about 200 on-site construction jobs during peak months. Additionally, First Wind and RMT hired many Utah-based subcontractors, suppliers and local businesses. The combined 306 MW facility will support 20 full-time, on-site operations and maintenance jobs.

“The local communities in Millard and Beaver Counties have benefited in so many ways from the Milford Wind projects,” said Millard County Commissioner Daron Smith. “Through direct spending or local subcontractors, this development has been an economic benefit for our towns, while also helping our environment. Southern Utah has tremendous potential for generating renewable power and these types of projects send the right message to our young people.”

Building on successful financings in Utah and other states, First Wind secured financing for the project through experienced providers. RBS Securities Inc. was the lead arranger and the following banks acted as joint lead arrangers: Banco Espirito Santo S.A. New York Branch, Santander Investment Securities Inc., CoBank, ACB, and SG Americas Securities, LLC.

Creating the clean energy from both the Milford I and Milford II projects requires no use of water. In addition, with an aggregate of 306 MW of clean, wind energy between the two projects, the power produced by Milford Wind is the equivalent of decreasing carbon dioxide emissions by almost 300,000 tons annually, calculated in accordance with the Environmental Protection Agency’s (U.S. EPA) Emissions and Generation Resource Integrated Database (E-GRID).

First Wind, an independent U.S.-based wind energy company, today announced that the construction of the 102 megawatt (MW) Milford Wind Corridor Phase II (Milford II) project has been completed and commercial operations have begun. Located in the counties of Millard and Beaver, Utah, the Milford Phases I and II are the two largest wind energy projects in Utah.

The 102 MW project, which features 68 1.5 MW GE turbines is located north of the 204 MW Milford Wind Corridor Phase I project (Milford I). At 306 MW, the combined output of Milford I and II has the capacity to generate enough energy to power up to 64,000 homes.

Pursuant to a power purchase agreement with Southern California Public Power Authority (SCPPA), power generated by Milford II is being supplied to the Los Angeles Department of Water and Power (LADWP) and Glendale Water and Power. Milford II adds to the already significant renewable energy that is being produced and delivered to Los Angeles, Burbank and Pasadena, California from the Milford I project.

“We are proud to announce the completion of this high quality wind project,” said Paul Gaynor, CEO, First Wind. “This project is now delivering clean, renewable power for use by thousands of homes and businesses. Putting the pieces together on Milford II has been a remarkable experience, and we are proud to have partnered with the State of Utah, our host counties of Beaver and Millard, our PPA partners – SCPPA, LADWP and Glendale – our landowner group including the Bureau of Land Management and the State of Utah School and Institutional Trust Lands Administration, our general contractor RMT, our subcontractors, and our lenders. This day is a celebration for everyone involved.”

“The Milford II Wind Power Project is an example of LADWP working smarter while boosting the amount of renewable energy provided to customers and reducing greenhouse gas emissions,” said LADWP General Manager Ronald O. Nichols. “With the completion of this project we ensure the delivery of 102 megawatts of wind power at a set price for the next 20 years.”

“We are pleased for the continued and successful working relationship with First Wind,” said Bill D. Carnahan, Executive Director of the Southern California Public Power Authority. “These projects are cost effective resources which benefit the local communities in Utah, while also supporting the renewable objectives of our communities in California. Delivering clean energy is a partnership in which we all share common objectives.”

RMT, which led the construction of the Milford I project in 2009, again led the construction activities for the Milford II project. Construction on the Milford II project began in the summer of 2010.

“We are pleased to have completed another project with First Wind,” said Steve Johansen, RMT President. “As with the first phase of the project, RMT hired local workers and subcontractors whenever possible so that the construction of this expansion provided economic benefits for the surrounding community and Utah.”

The Milford Wind project has been an ongoing source of jobs, business activity, and tax revenue for Millard, Beaver and adjacent counties. Milford II supported about 200 on-site construction jobs during peak months. Additionally, First Wind and RMT hired many Utah-based subcontractors, suppliers and local businesses. The combined 306 MW facility will support 20 full-time, on-site operations and maintenance jobs.

“The local communities in Millard and Beaver Counties have benefited in so many ways from the Milford Wind projects,” said Millard County Commissioner Daron Smith. “Through direct spending or local subcontractors, this development has been an economic benefit for our towns, while also helping our environment. Southern Utah has tremendous potential for generating renewable power and these types of projects send the right message to our young people.”

Building on successful financings in Utah and other states, First Wind secured financing for the project through experienced providers. RBS Securities Inc. was the lead arranger and the following banks acted as joint lead arrangers: Banco Espirito Santo S.A. New York Branch, Santander Investment Securities Inc., CoBank, ACB, and SG Americas Securities, LLC.

Creating the clean energy from both the Milford I and Milford II projects requires no use of water. In addition, with an aggregate of 306 MW of clean, wind energy between the two projects, the power produced by Milford Wind is the equivalent of decreasing carbon dioxide emissions by almost 300,000 tons annually, calculated in accordance with the Environmental Protection Agency’s (U.S. EPA) Emissions and Generation Resource Integrated Database (E-GRID).

Sunday, May 08, 2011

Orangeville anti-wind group aims to continue lawsuit appeal

ORANGEVILLE — Clear Skies Over Orangeville aims to continue its appeal of its lawsuit against the town’s 2009 zoning amendments.

The group that opposes the proposed Stony Creek Wind Farm filed a motion Monday to reargue the case. It is also asking permission to appeal to the Court of Appeals in Albany.

If those motions are denied, CSOO will pursue a separate request for permission to appeal directly to the Court of Appeals, said Gary Abraham, the group’s attorney.

CSOO plans to argue there was a lack of any factual basis for the town’s zoning amendments allowing 50 decibels for such projects; and ethics violations by the Town Board.

Although not part of the appeal, Abraham has questioned the joint motion filed by Invenergy.

“During the course of the proceedings, and particularly in the appellate court, the town and Invenergy put in briefs that were identical,” he said in an interview last month. “I strongly suspect Invenergy did all the legal work, which would constitute a questionable gift of services.”

But that issue isn’t part of the appeal.

Town Attorney David DiMatteo said Invenergy’s attorney Hodgson Russ has been involved since CSOO’s lawsuit was first heard in court.

“Obviously we collaborated with regards to the responses,” he said. “Invenergy’s attorney Hodgson Russ entered understanding our interests were unified, and were granted entry by Supreme Court, granting them permission to intervene because our interests were so similar.”

He said the court and appeals judges weren’t swayed by CSOO’s previous arguments.

If successful, the CSOO appeal would be the latest in the ongoing legal action over the project.

The group originally filed suit in Jan.10. Its members sought to invalidate the town’s 2009 zoning amendments, which set the rules for wind turbine development.

The lawsuit was dismissed by State Supreme Court Judge Patrick NeMoyer. The CSOO members appealed, but a five-judge panel upheld his decision in a March ruling.

The group’s arguments were almost entirely rejected in NeMoyer’s decision, which found no conflicts of interest or ethics violations.

In an open letter to town residents last month, the Town Board said the lawsuit and appeal had cost the town $29,789.61. Abraham said last month that CSOO was reluctant to say how much it’s spent, but that its funding was raised by people in the community, and did not include outside sources.

The Chicago-based Invenergy is proposing a 59-turbine wind farm in Orangeville. It operates a similar project in the adjacent town of Sheldon.

.

The group that opposes the proposed Stony Creek Wind Farm filed a motion Monday to reargue the case. It is also asking permission to appeal to the Court of Appeals in Albany.

If those motions are denied, CSOO will pursue a separate request for permission to appeal directly to the Court of Appeals, said Gary Abraham, the group’s attorney.

CSOO plans to argue there was a lack of any factual basis for the town’s zoning amendments allowing 50 decibels for such projects; and ethics violations by the Town Board.

Although not part of the appeal, Abraham has questioned the joint motion filed by Invenergy.

“During the course of the proceedings, and particularly in the appellate court, the town and Invenergy put in briefs that were identical,” he said in an interview last month. “I strongly suspect Invenergy did all the legal work, which would constitute a questionable gift of services.”

But that issue isn’t part of the appeal.

Town Attorney David DiMatteo said Invenergy’s attorney Hodgson Russ has been involved since CSOO’s lawsuit was first heard in court.

“Obviously we collaborated with regards to the responses,” he said. “Invenergy’s attorney Hodgson Russ entered understanding our interests were unified, and were granted entry by Supreme Court, granting them permission to intervene because our interests were so similar.”

He said the court and appeals judges weren’t swayed by CSOO’s previous arguments.

If successful, the CSOO appeal would be the latest in the ongoing legal action over the project.

The group originally filed suit in Jan.10. Its members sought to invalidate the town’s 2009 zoning amendments, which set the rules for wind turbine development.

The lawsuit was dismissed by State Supreme Court Judge Patrick NeMoyer. The CSOO members appealed, but a five-judge panel upheld his decision in a March ruling.

The group’s arguments were almost entirely rejected in NeMoyer’s decision, which found no conflicts of interest or ethics violations.

In an open letter to town residents last month, the Town Board said the lawsuit and appeal had cost the town $29,789.61. Abraham said last month that CSOO was reluctant to say how much it’s spent, but that its funding was raised by people in the community, and did not include outside sources.

The Chicago-based Invenergy is proposing a 59-turbine wind farm in Orangeville. It operates a similar project in the adjacent town of Sheldon.

.

Thursday, May 05, 2011

Zotos' wind turbines idled by snag

What was billed as the largest wind energy project at a manufacturing facility in the United States was rolled out last summer as a showcase of green energy.

But the blades have remained motionless on the two 364-foot wind turbines erected in January at the Zotos International plant in Geneva.

New York State Electric and Gas Co. spokesman Clayton Ellis said in an email that the towers are too close to NYSEG power lines.

"We anticipate resolution of this issue by relocating the power lines," Ellis said.

He declined to respond to any other questions.

Zotos vice president of operations Anthony Perdigao also released a statement by email: "With respect to the wind generation project, Zotos is working through some operational issues with NYSEG, and we are confident that we will resolve those issues."

According to the American Wind Energy Association, the $7 million project is the largest of any manufacturing company in the U.S.

Federal economic stimulus funding covered 30 percent of the cost.

The turbines are projected to generate about 70 percent of the plant's energy. Zotos spends about $1 million a year on electricity.

A maker of hair dyes, Zotos has more than 360 full-time and 310 flex-time employees at the 660,000-square-foot plant on Forge Avenue in the Ontario County city.

But the blades have remained motionless on the two 364-foot wind turbines erected in January at the Zotos International plant in Geneva.

New York State Electric and Gas Co. spokesman Clayton Ellis said in an email that the towers are too close to NYSEG power lines.

"We anticipate resolution of this issue by relocating the power lines," Ellis said.

He declined to respond to any other questions.

Zotos vice president of operations Anthony Perdigao also released a statement by email: "With respect to the wind generation project, Zotos is working through some operational issues with NYSEG, and we are confident that we will resolve those issues."

According to the American Wind Energy Association, the $7 million project is the largest of any manufacturing company in the U.S.

Federal economic stimulus funding covered 30 percent of the cost.

The turbines are projected to generate about 70 percent of the plant's energy. Zotos spends about $1 million a year on electricity.

A maker of hair dyes, Zotos has more than 360 full-time and 310 flex-time employees at the 660,000-square-foot plant on Forge Avenue in the Ontario County city.

Wednesday, May 04, 2011

Changes for First Wind mean little to Cohocton

Cohocton Supervisor Jack Zigenfus was notified Monday about the changes with First Wind.

“They didn’t want the town to be alarmed,” he said. “They called me so I wouldn’t hear about it second-hand.”

The only change for the town will be in the insurance bonds regarding agreement with First Wind. Zigenfus said the insurance company will have to issue new bonds, worth $300,000, after the agreement between the companies.

Zigenfus pointed to First Wind depositing $100,000 in the town’s bank account Saturday as an example of business continuing as usual with the wind energy company.

The $100,000 is payment as part of a six-year road use agreement between the town and company. The agreement is now in its fifth year, said the supervisor.

Projects started and completed by First Wind that are transferring to the operating company include the Cohocton Wind and Steel Winds I in Lackawanna, as well as a project in Vermont and four projects in Maine, according to the release.

Read the entire article

“They didn’t want the town to be alarmed,” he said. “They called me so I wouldn’t hear about it second-hand.”

The only change for the town will be in the insurance bonds regarding agreement with First Wind. Zigenfus said the insurance company will have to issue new bonds, worth $300,000, after the agreement between the companies.

Zigenfus pointed to First Wind depositing $100,000 in the town’s bank account Saturday as an example of business continuing as usual with the wind energy company.

The $100,000 is payment as part of a six-year road use agreement between the town and company. The agreement is now in its fifth year, said the supervisor.

Projects started and completed by First Wind that are transferring to the operating company include the Cohocton Wind and Steel Winds I in Lackawanna, as well as a project in Vermont and four projects in Maine, according to the release.

Read the entire article

Tuesday, May 03, 2011

First Wind enters new partnership agreement

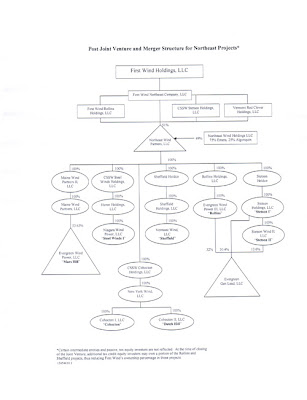

First Wind Holdings Inc., Algonquin Power and Utilities Corp., and Emera Inc. have entered into an agreement to jointly construct, own, and operate wind energy projects in the Northeast, including projects in Maine and Vermont, the three companies said in a press release issued over the weekend.

Boston-based First Wind has a portfolio of five operating wind energy projects and two projects about to go operational. Those assets will become part of an operating company that First Wind will own 51 percent of, the press release said. Emera and Algonquin, both based in Canada, are entering into a joint venture called Northeast Wind that will own the remaining 49 percent of the operating company.

Last year, First Wind drew up plans to go public with an initial public stock offering. In October, First Wind suddenly pulled the plug on the planned IPO after investor demand went slack.

Commenting on First Wind's agreement with Algonquin Power and Emera, a First Wind spokesman wrote in an e-mail that First Wind is excited about this new agreement "because it provides a significant amount of capital so we can build more projects down the road."

Emera and Algonquin have scheduled an analyst call for this morning to discuss the agreement.

Algonquin Power & Utilities owns and operates a diversified portfolio of clean renewable electric generation and sustainable utility distribution businesses in North America.

Emera is an energy and services company with $6.3 billion in assets and revenues of $1.6 billion.

Boston-based First Wind has a portfolio of five operating wind energy projects and two projects about to go operational. Those assets will become part of an operating company that First Wind will own 51 percent of, the press release said. Emera and Algonquin, both based in Canada, are entering into a joint venture called Northeast Wind that will own the remaining 49 percent of the operating company.

Last year, First Wind drew up plans to go public with an initial public stock offering. In October, First Wind suddenly pulled the plug on the planned IPO after investor demand went slack.

Commenting on First Wind's agreement with Algonquin Power and Emera, a First Wind spokesman wrote in an e-mail that First Wind is excited about this new agreement "because it provides a significant amount of capital so we can build more projects down the road."

Emera and Algonquin have scheduled an analyst call for this morning to discuss the agreement.

Algonquin Power & Utilities owns and operates a diversified portfolio of clean renewable electric generation and sustainable utility distribution businesses in North America.

Emera is an energy and services company with $6.3 billion in assets and revenues of $1.6 billion.

Monday, May 02, 2011

Wind Power Promises and Predictions Gone Awry

The predictions and promises made by wind developers for Northern New York in 2005-2007 can now be analyzed in the light of a number of wind projects that have been in operation for 3 or more years.

I have scrutinized a number of news articles, press releases, and meeting minutes from the above period on wind power. Developer promises have come to pass in nearly none of the cases.

Most of the wind plant statistics I have quoted refer to the 106.5 MW capacity Chateaugay project. (All are verifiable). I use Chateaugay because it is in Franklin County and is the largest of the four area wind plants. The other three -- Clinton, Ellenburgh, and Altona -- have virtually identical outputs.

John Quirke of Noble Power said that local wind projects should average 30-35% of their listed capacity. In 2010, however, the Chateaugay wind plant only averaged 20.6%. The predicted value was exaggerated 58% over actual. According to Public Service Commission Report #09E-0497, if transmission losses and wind project electric use are subtracted, the wind projects only returned about 10% of their advertised capacity to consumers.

Noble’s Mark Lyons said the Chateaugay project would produce enough electricity to power 33,000 homes. The actual output of 192,000 MWh in 2010 would power fewer than 18,000 homes, again a significant exaggeration over estimate. There is a huge caveat in these figures, since Chateaugay had 1,222 hours of no output (that’s more than 50 days). Since this down time is unpredictable, Chateaugay can supply reliable electricity to ZERO homes. The low average value of NNY wind speeds coupled with a very high degree of variability means Northern NY is NOT suitable for economically viable nor dependable industrial wind installations.

In hyping a tentative 70 turbine project for Malone, Noble's Mark Lyons predicted it would create up to 45 jobs. This sounds like an exaggeration since the 195 turbines at Tug Hill created less than 40 jobs. The job creation aspect of wind projects is also often over-inflated. A Dept. of Energy document tells of a loan guarantee to First Wind for $117 M for a project to create 10 jobs. That’s nearly $12M per job.

All of Noble’s presenters claimed that wind would produce cheap electricity since the fuel is free. The reality? Chateaugay’s electricity cost of $38 MWh is more than 20% higher than the cost of power from the FDR Seaway hydro plant. Maybe wind power should be touted as “not so cheap electricity”. The sale of electricity in Chateaugay will not be sufficient to pay for the turbines before they are worn out!!

Chuck Hinckley said “there is no evidence of property devaluation near large wind turbines”. In fact, there are a number of well done professional studies that have found significant property devaluation near wind turbines. Studies done in Texas and Wisconsin are among the best. Some local realtors avoid listing properties near turbines because they are hard to sell.

Dan Boyd, Noble’s project manager, stated on several occasions that wind power could reduce our dependence on foreign oil. Any such effect is laughingly small. The entire 2010 energy production at the Chateaugay wind plant is equivalent to a mere 17 minutes of imported oil. Since oil and electricity generally serve different uses, the effect is negligible. To produce 25% of imported oils energy would take approx. ½ million turbines occupying 30+ million acres (5 Adirondack Parks). An impossible dream.

All of Noble’s spokepersons claimed that free and clean windpower would combat global warming. No one mentioned the huge carbon emissions debt created when building a wind project.

An in-depth study by the internationally respected Pacific Research Institute found that a typical project must operate for 7 years at full capacity before it pays back all the emissions produced in manufacture and construction. Since our local wind plants operate at about 20% capacity, it would take 30+ years to become emission free. Not bad for machinery that the manufacturer (GE) says will last 20 yrs.

Then there’s the mercury problem. Through cement use, wind projects have released enough airborne mercury to render most of the fish in the Adirondacks inedible.

Mark Lyons and Chuck Hinckley insisted that Noble would pay its fair share of taxes. Yet the PILOT agreement with Franklin County has most homeowners paying 10 times the tax rate that Noble does.

In the PILOT agreement with Clinton County IDA, Noble offered to pay a bonus of $1000/MW every time the annual capacity factor of any of their projects exceeded 35%. The problem? No NY wind project has ever exceeded a 35% annual c.f. Probably none east of the Mississippi has ever done so. Did Noble know this? If so, it was a con.

Lyons insisted that all the land around turbines could have the same use it could have had before they were installed. Not quite. If a turbine had to be sited say 1500’ from a home for health and safety reasons, then future homes could be built no closer than 1500’ to existing turbines. Thus, each turbine would exclude 160+ acres from home building.

Lyons and others claimed that 1&1/2 times the tower height was a safe setback from roads, trails and other areas frequented by people. Basic physics, however, shows that debris from blades at normal operating speeds can fly up to 1000’ far more than 1&1/2 tower heights. The runaway turbine that self-destructed in Altona in 2009 could theoretically throw debris up to 1640’. 1&1/2 tower height setbacks are woefully inadequate, actually downright dangerous.

Lyons and Hinckley maintained that noise was not a problem and the sound emitted by turbines was “no louder than a refrigerator”. Neighbors soon found the turbines at times much louder than a refrigerator. Medical experts are just learning that sound undetectable to the human ear (infrasound) is causing serious health problems. This is known as Wind Turbine Syndrome(WTS). These problems have been diagnosed in hundreds of people worldwide who live near wind turbines. This has led the prestigious French Societe de Medicine to recommend 2 km. (1.24mi.) between turbines and all houses.

Lyons said their turbines only turned at 20 RPM’s therefore they were little threat to birds. A little math shows that the tip speed of a 20 RPM 240’ diameter rotor is nearly 180 mph. -- certainly fast enough to do in most birds!

One has to wonder if the huge discrepancy between what the wind developers promised and what ultimately transpired is due to ignorance of a fledgling company that did not do its homework or the result of a concerted deceptive propaganda campaign designed to dupe a naïve and trusting rural populace?

I have scrutinized a number of news articles, press releases, and meeting minutes from the above period on wind power. Developer promises have come to pass in nearly none of the cases.

Most of the wind plant statistics I have quoted refer to the 106.5 MW capacity Chateaugay project. (All are verifiable). I use Chateaugay because it is in Franklin County and is the largest of the four area wind plants. The other three -- Clinton, Ellenburgh, and Altona -- have virtually identical outputs.

John Quirke of Noble Power said that local wind projects should average 30-35% of their listed capacity. In 2010, however, the Chateaugay wind plant only averaged 20.6%. The predicted value was exaggerated 58% over actual. According to Public Service Commission Report #09E-0497, if transmission losses and wind project electric use are subtracted, the wind projects only returned about 10% of their advertised capacity to consumers.

Noble’s Mark Lyons said the Chateaugay project would produce enough electricity to power 33,000 homes. The actual output of 192,000 MWh in 2010 would power fewer than 18,000 homes, again a significant exaggeration over estimate. There is a huge caveat in these figures, since Chateaugay had 1,222 hours of no output (that’s more than 50 days). Since this down time is unpredictable, Chateaugay can supply reliable electricity to ZERO homes. The low average value of NNY wind speeds coupled with a very high degree of variability means Northern NY is NOT suitable for economically viable nor dependable industrial wind installations.

In hyping a tentative 70 turbine project for Malone, Noble's Mark Lyons predicted it would create up to 45 jobs. This sounds like an exaggeration since the 195 turbines at Tug Hill created less than 40 jobs. The job creation aspect of wind projects is also often over-inflated. A Dept. of Energy document tells of a loan guarantee to First Wind for $117 M for a project to create 10 jobs. That’s nearly $12M per job.

All of Noble’s presenters claimed that wind would produce cheap electricity since the fuel is free. The reality? Chateaugay’s electricity cost of $38 MWh is more than 20% higher than the cost of power from the FDR Seaway hydro plant. Maybe wind power should be touted as “not so cheap electricity”. The sale of electricity in Chateaugay will not be sufficient to pay for the turbines before they are worn out!!

Chuck Hinckley said “there is no evidence of property devaluation near large wind turbines”. In fact, there are a number of well done professional studies that have found significant property devaluation near wind turbines. Studies done in Texas and Wisconsin are among the best. Some local realtors avoid listing properties near turbines because they are hard to sell.

Dan Boyd, Noble’s project manager, stated on several occasions that wind power could reduce our dependence on foreign oil. Any such effect is laughingly small. The entire 2010 energy production at the Chateaugay wind plant is equivalent to a mere 17 minutes of imported oil. Since oil and electricity generally serve different uses, the effect is negligible. To produce 25% of imported oils energy would take approx. ½ million turbines occupying 30+ million acres (5 Adirondack Parks). An impossible dream.

All of Noble’s spokepersons claimed that free and clean windpower would combat global warming. No one mentioned the huge carbon emissions debt created when building a wind project.

An in-depth study by the internationally respected Pacific Research Institute found that a typical project must operate for 7 years at full capacity before it pays back all the emissions produced in manufacture and construction. Since our local wind plants operate at about 20% capacity, it would take 30+ years to become emission free. Not bad for machinery that the manufacturer (GE) says will last 20 yrs.

Then there’s the mercury problem. Through cement use, wind projects have released enough airborne mercury to render most of the fish in the Adirondacks inedible.

Mark Lyons and Chuck Hinckley insisted that Noble would pay its fair share of taxes. Yet the PILOT agreement with Franklin County has most homeowners paying 10 times the tax rate that Noble does.

In the PILOT agreement with Clinton County IDA, Noble offered to pay a bonus of $1000/MW every time the annual capacity factor of any of their projects exceeded 35%. The problem? No NY wind project has ever exceeded a 35% annual c.f. Probably none east of the Mississippi has ever done so. Did Noble know this? If so, it was a con.

Lyons insisted that all the land around turbines could have the same use it could have had before they were installed. Not quite. If a turbine had to be sited say 1500’ from a home for health and safety reasons, then future homes could be built no closer than 1500’ to existing turbines. Thus, each turbine would exclude 160+ acres from home building.

Lyons and others claimed that 1&1/2 times the tower height was a safe setback from roads, trails and other areas frequented by people. Basic physics, however, shows that debris from blades at normal operating speeds can fly up to 1000’ far more than 1&1/2 tower heights. The runaway turbine that self-destructed in Altona in 2009 could theoretically throw debris up to 1640’. 1&1/2 tower height setbacks are woefully inadequate, actually downright dangerous.

Lyons and Hinckley maintained that noise was not a problem and the sound emitted by turbines was “no louder than a refrigerator”. Neighbors soon found the turbines at times much louder than a refrigerator. Medical experts are just learning that sound undetectable to the human ear (infrasound) is causing serious health problems. This is known as Wind Turbine Syndrome(WTS). These problems have been diagnosed in hundreds of people worldwide who live near wind turbines. This has led the prestigious French Societe de Medicine to recommend 2 km. (1.24mi.) between turbines and all houses.

Lyons said their turbines only turned at 20 RPM’s therefore they were little threat to birds. A little math shows that the tip speed of a 20 RPM 240’ diameter rotor is nearly 180 mph. -- certainly fast enough to do in most birds!

One has to wonder if the huge discrepancy between what the wind developers promised and what ultimately transpired is due to ignorance of a fledgling company that did not do its homework or the result of a concerted deceptive propaganda campaign designed to dupe a naïve and trusting rural populace?

Algonquin Power and Emera Sign New Strategic Co-Operation Agreement

Algonquin Power and Utilities Corp. (APUC) (TSX: AQN) and Emera Inc. (TSX: EMA) have signed a new strategic investment and co-operation agreement pursuant to which the two companies will pursue projects in each specific areas or in tandem in projects of mutual benefits.